Why You Need Critical Illness Insurance

- 11/25/2020The risks of experiencing critical illness are too big to ignore

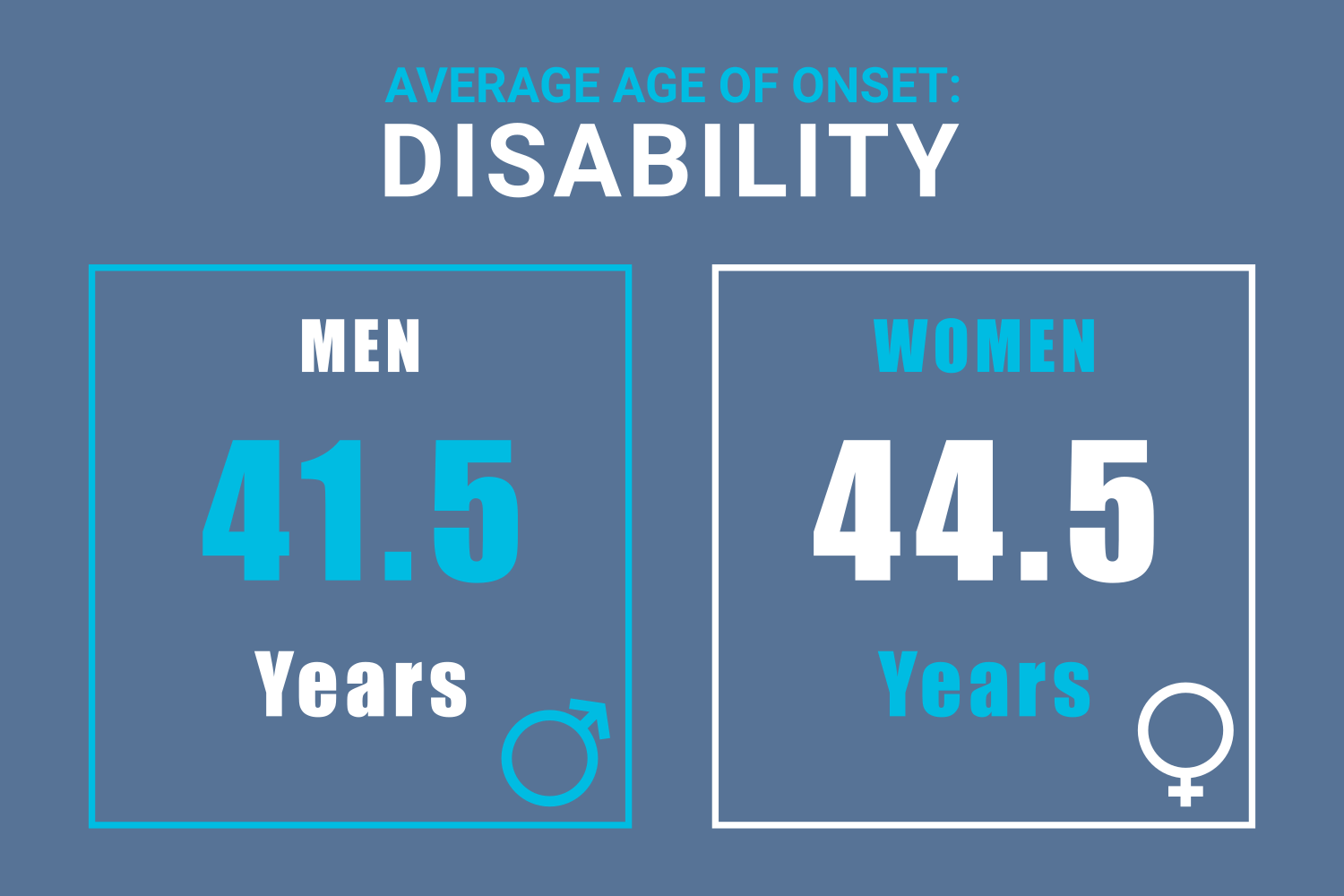

While the common cold or flu may mean you need to take a few days off from work so you can recover, a critical illness can have long-lasting impacts on your life — physically and financially. From heart attacks and strokes, to a cancer diagnosis, no one likes to think about becoming seriously ill, but it happens more often than you may realize and working-age Canadians are most at risk. Illnesses are six times more likely to be the cause of disability than accidents, with today’s most prevalent illnesses striking during prime working years.

Not only does a critical illness take an emotional toll on you and your family, the financial impact of such an event can deplete your savings in mere months, especially if you are suddenly unable to work. That’s why critical illness insurance is a necessary component of a comprehensive financial plan.

In this article we’ll explore some of the most common critical illnesses in Canada and the effect they could have on your savings.

Top causes of critical illness in Canada

The term critical illness refers to a life-threatening or life-changing diagnosis that requires both immediate and/or long-term medical intervention to recover.

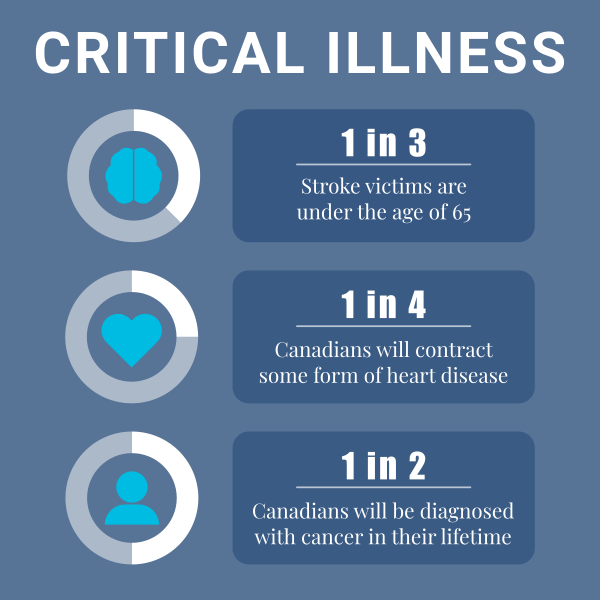

Here are the top three critical illnesses in Canada that make up as much as 85% of critical illness claims:

Stroke

People often associate strokes with old age, but one third of stroke victims are under the age of 65. The Heart and Stroke Foundation of Canada (HSFC) estimates that there are currently more than 400,000 Canadians living with a long-term disability due to a stroke. This is because the majority of individuals (80%) now survive a stroke, thanks to increased awareness and medical advancements. While this is a welcome statistic, it also means that more people need to adapt to living with a disability resulting from this health event. They may be unable to work for months or years, and need a way to pay for medical expenses while maintaining their family’s standard of living.

Like with many critical illnesses, when a stroke is treated quickly it can translate into better recoveries and lowered health care costs, according to HSFC. While the average cost of stroke treatment varies between patients, it’s generally estimated to cost anywhere between $17,000 and $56,000.

On the other hand, the longer the wait for treatment the more severe the side effects could be. Survival rates are high, but 60% of patients are left with a disability that requires long-term forms of care, lifestyle modifications, and prolonged loss of income.

Heart Attack

The HSFC also reports that heart attacks, and subsequent heart failure, are on the rise across the country. One in four Canadians will contract heart disease in their lifetime, and approximately 75,000 Canadians suffer a heart attack each year.

As more people survive heart attacks thanks to new technologies and increased awareness of the warning signs, they go on to live with a weakened essential organ. Researchers from the HSFC estimate that at least 600,000 Canadians are living with heart failure and need to readjust their lifestyle and increase their medical care (and subsequent costs) to stay healthy in the long term.

While there is no average cost of heart failure treatment available, it’s important to understand how it will impact your life in the long term. You may be unable to work while having to pay for medications not covered by your current health plan. When you need to prioritize staying healthy, worrying about finances and your livelihood should be the last thing on your mind.

Cancer

Cancer has become one of the most prevalent causes of disability for Canadians of all ages. According to the Canadian Cancer Society, nearly one in two Canadians will develop cancer during their lifetime. Thanks to significant research and medical advancements, over 60% of cancer patients will survive at least 5 years after diagnosis, and many go on to live long, rewarding lives.

While chances of recovery from cancer are high, so too is the financial impact. It’s estimated that the average cost of a single course of treatment with newer cancer drugs is $65,000 – more than the median after-tax annual Canadian income.

The fact remains, cancer is both physically and financially draining. Few people expect to get cancer, but the increasing odds of diagnosis and the magnitude of its potential financial impact are too significant to dismiss. The only way to be financially prepared for an unexpected condition such as cancer, heart attack or stroke is to invest in critical illness insurance.

How can critical illness insurance help

Unfortunately, less than 10% of Canadians currently have personal critical illness or long-term care insurance. At The Edge Benefits, we understand that the risks and financial impact of critical illnesses are too large to ignore. It’s our mission to inform Canadians of their risks, increase the population’s financial awareness, and break down traditional barriers that make it difficult for working adults to get the coverage they need, such as personal or family medical history.

That’s why we offer Guaranteed Issue Critical Illness coverage available in monetary units that match your budget, and a no-hassle approach to securing up to $100,000 of critical illness protection — the highest amount of guaranteed coverage in the Canadian industry. With a quick and easy application process, you can receive the peace of mind that if you become ill, personal finances won’t supersede your ability to afford life-saving treatment.

EDGE’s Critical Illness benefit provides a tax-free lump-sum payment if you are diagnosed with any of the aforementioned illnesses, in addition to 20 other covered conditions such as blindness, deafness, loss of speech or independence, major organ failure, paralysis, coma, ALS, MS, Parkinson’s disease, amongst other critical conditions.

We also understand that severe illnesses can happen at any time in your life, or even multiple times. EDGE offers a Child Critical Illness rider for only a few dollars per month, and our free Second Event Benefit means you can receive compensation for a second, unrelated critical condition if needed. Receive a free quote today to learn how affordable Critical Illness insurance can be.

Getting benefits should be easy.The EDGE makes it affordable and stress-free.

Get a QuoteSources

https://www.heartandstroke.ca/-/media/pdf-files/canada/stroke-report/strokereport2017en.ashx#:~:text=The%20Canadian%20population%20is%20aging,%25%20%E2%80%93%20now%20survive%20a%20stroke

https://www.heartandstroke.ca/-/media/pdf-files/canada/2019-report/heartandstrokereport2019.ashx

https://www.cancer.ca/en/cancer-information/cancer-101/cancer-statistics-at-a-glance/?region=on